UFI, the Global Association of the Exhibition Industry, has released the July 2020 edition of its Global Barometer research report which reveals the impact that the COVID-19 pandemic has had on the global exhibition industry.

“While the industry remains confident that it will bounce back, everyone is aware that this crisis will lead to major changes in the way exhibitions are produced, especially with a push towards more digital elements before, during, and between events.”

“On the back of an exceptional year in 2019, we are now seeing an unprecedented drop in revenues around the world. While the industry remains confident that it will bounce back, everyone is aware that this crisis will lead to major changes in the way exhibitions are produced, especially with a push towards more digital elements before, during, and between events,” says Kai Hattendorf, UFI Managing Director and CEO.

The findings include the following:

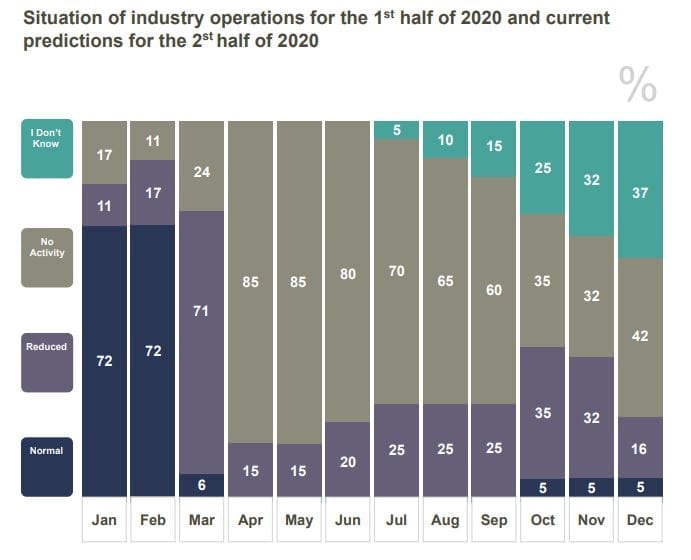

- Most regions have experienced a similar lockdown pattern, with 85% of companies reporting a “normal” level of activity in January, which dropped to 15% in March, and then stayed between 5% and 6% from April to June. Nearly three out of four companies worldwide (73%) reported “no activity” in April and May.

- Overall, revenues for the first half of 2020 dropped by roughly two thirds, when compared with the same period last year. It is anticipated that revenues for 2020 will equate to 39% of 2019. Regionally, the Middle East and Africa is expected to fare slightly worse, bringing in only 31% of last year’s revenue. In South Africa, this is even lower, at 22%. Europe and North America are expected to have the strongest performance, with 44% for both.

- Four out of ten (39%) of all companies have reported a loss in profits. Again, when looking at the Middle East and Africa specifically, this figure changes to 48% of companies – or nearly half. In South Africa, this increases to 90%. Only 7% of companies globally expect a stable or increased profit for 2020.

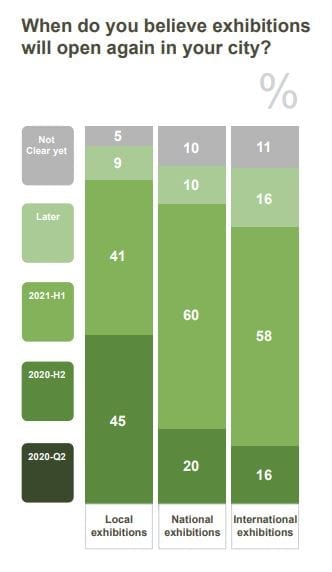

- When looking forwards, the majority of respondents expect “local” and “national” exhibitions to resume during the second half of 2020, and that international exhibitions will only resume in 2021. A “reduced” level of activity is anticipated by two thirds of companies, with a slow recovery. The outlook in the Middle East and Africa is less confident, with many indicating that they expect “national” exhibitions will only resume in 2021. In South Africa 70% of respondents expect this.

- A majority of companies did not get any public financial support, while 44% did. Of these, a majority said it equated to less than 10% of their costs. Generally financial public support is less common in the Middle East and Africa, where only 31% of companies benefited in some way. In South Africa, this drops to 20% of companies.

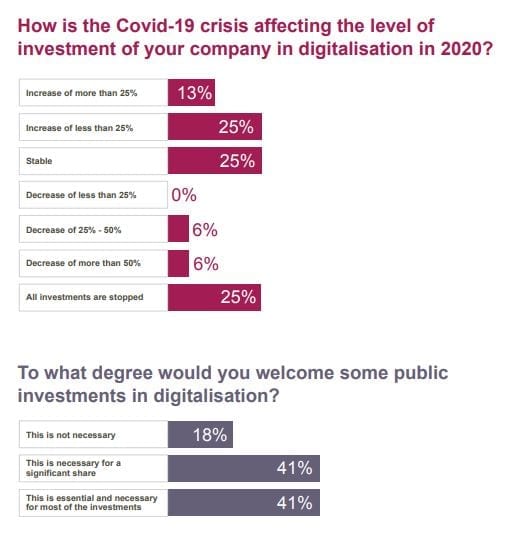

- Overall, 87% of companies applied cost reductions. This includes 44% of companies who stopped all of their investments, and 32% of companies who will decrease theirs. In South Africa, 95% of respondents implemented cost reductions, of which 53% stopped all investments and 24% will decrease investments.

- Meanwhile 50% of all respondents are increasing their investments in digitalisation programmes. Slightly fewer companies are doing this in South Africa, with 38% of companies saying they will increase investments in it.

- One in three companies do not yet know what requirements will be needed to comply with new COVID-19 protocols, while one in four say the requirements will represent more than 10% of their overall costs.

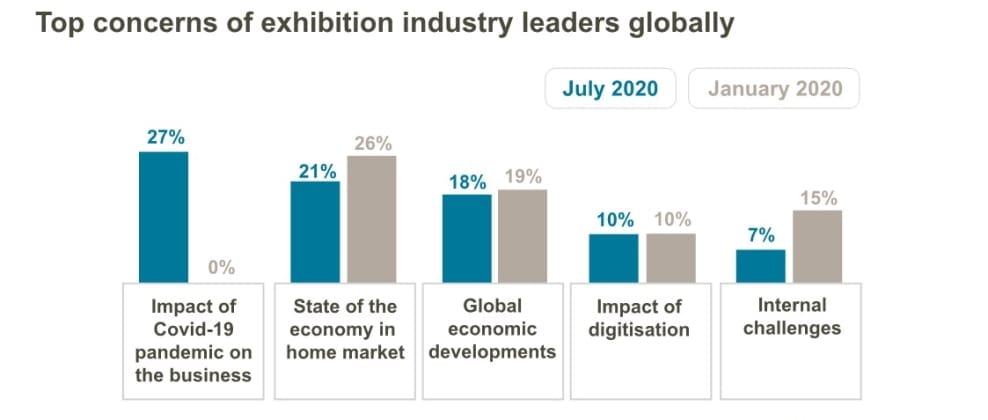

The most important business issues were ranked globally as follows:

- “Impact of COVID-19 pandemic on the business” is considered as the most important business issue (27% of combined answers)

- “State of the economy in home market” (21%) – however this ranked as the top issue in the Middle East and Africa, and Central and South America. In South Africa, this was the primary concern for one out of three companies (33%).

- “Global economic developments” (18%)

- “Impact of digitalisation” (10%)

You can download the full report here.

The insights were collected from 459 companies in 62 countries and regions, in collaboration with 17 UFI Member Associations – including AAXO (The Association of African Exhibition Organisers) and EXSA (Exhibition and Event Association of Southern Africa) in South Africa.

The next UFI Global Barometer survey will be conducted in December 2020.