SA’s tourism business performance dipped in the second quarter of this year according to the TBCSA FNB Tourism Business Index (TBI) released this week.

The latest report showed a score of 94.7 across April, May and June, indicating performance just below normal, and almost 18 points below January to March’s 112.4 index reading. The industry had already shown an expectation of a dip with a projected 103 performance, but actual performance was somewhat worse than expected at 94.7. Expectations for quarter 3 are at about the same level at 98.

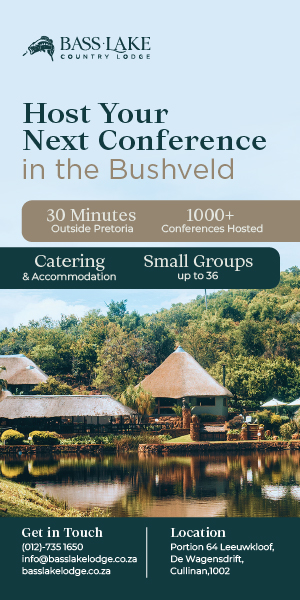

A score of 100 is regarded as the normal trading climate. The lower reading emanated mainly from the ‘Other Tourism’ business segment (excluding accommodation), which includes travel agents, transport operators and conference centres. ‘Other Tourism’ businesses achieved a score of 86.2 points only.

Meanwhile the accommodation sector still performed better than normal achieving an index of 105,8; although it is down from the 116.1 score which was registered in the first quarter, but slightly ahead of the forecast performance index of 103.

The numbers come off the back of the TBCSA’s Annual General Meeting last week, where the newly appointed Minister of Tourism, Derek Hanekom met with the travel and tourism trade. In this meeting he lauded the private sector’s contribution to the growth of the industry over the years but stressed the need to ensure that the growth was inclusive and contributed towards addressing the challenges of inequality and poverty in the country.

The Tourism Business Council (TBCSA) says whilst it welcomed the Minister’s views, it remained concerned about various factors which continue to bar sustainable growth.

“The biggest challenge facing many tourism businesses remains the rising cost of doing business which can also be attributed to government legislation, regulations and input costs as 44% of TBI respondents cited. Insufficient domestic and international leisure demand, especially from South Africa’s key source markets also featured heavily as constraints on performance” says TBCSA CEO Mmatšatši Ramawela.

Businesses, which fall under the ‘Other Tourism’ segment, are also affected by threats of a struggling economy.

On the positive side, employment level expectation for the next quarter is an encouraging balance at +2,8% and +8,6% for accommodation and ‘other’ tourism business respectively, indicating some very modest growth in employment. The Minister’s AGM address identified job creation in the industry as a key priority.

Head of Advisory Services at Grant Thornton, Gillian Saunders, said: “This is especially welcomed after the accommodation sector’s – 49,7% negative outlook on balance for employment growth in the second quarter. It indicates a re-stabilization of employment levels after what appears to have been major restructuring. Going forward no doubt the industry will continue to grow employment as it maintains reasonable overall performance levels”.

Overall both the accommodation sector and other tourism businesses have a positive outlook of on balance +5.1% and +20% respectively when considering the year ahead. In comparison, the RMB/BER Index, which represents general business confidence, has continued to remain low, recording 41 index points for both quarter 1 and quarter 2 of 2014. Tourism businesses remain slightly ahead of this in performance, still indicating more buoyancy than the economy generally. More encouraging is that tourism businesses are hoping to beat the negative curve across the rest of the year.

“Essentially, the tourism business index is telling us that the improved trading conditions in the tourism sector have receded somewhat and that challenges remain, but the fundamentals for tourism are still good,” Ramawela concluded.

Click Here for the 2014 Q2 TBI report.